Partnership Income Tax Malaysia

Individuals Two companies Individual and Company Individual. LLP have a similar tax treatment like Company where chargeable Income from LLP will be taxed at the LLP level at tax rate of 24 generally.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Up to RM3000 for kindergarten and daycare fees.

. Partnership income tax no. Income tax rates. However LLP with capital contribution of RM25.

Registration no Registration number with. D Enter the partnership income tax no. It will be applied to your chargeable income which is obtained after deducting all your business losses allowable expenses approved donations and individual tax reliefs.

Partnership can exist between. D 0012345602 5 Basis of Apportionment Denominator used for. INTRODUCTION Gains or profits from carrying on a partnership are liable to tax.

Income tax rebate for new SMEs or Limited Liability Partnerships LLPs Pursuant to the Finance Act 2020 a new Section 6D was introduced into. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income.

An effective petroleum income tax rate of 25 applies on income from. 2 Income Tax No. Resident companies are taxed at the rate of 24.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50. Tax is imposed annually on individuals who receive income in respect of. In the boxes provided.

L Co Plt. In the box provided. C Dividends interest or discounts.

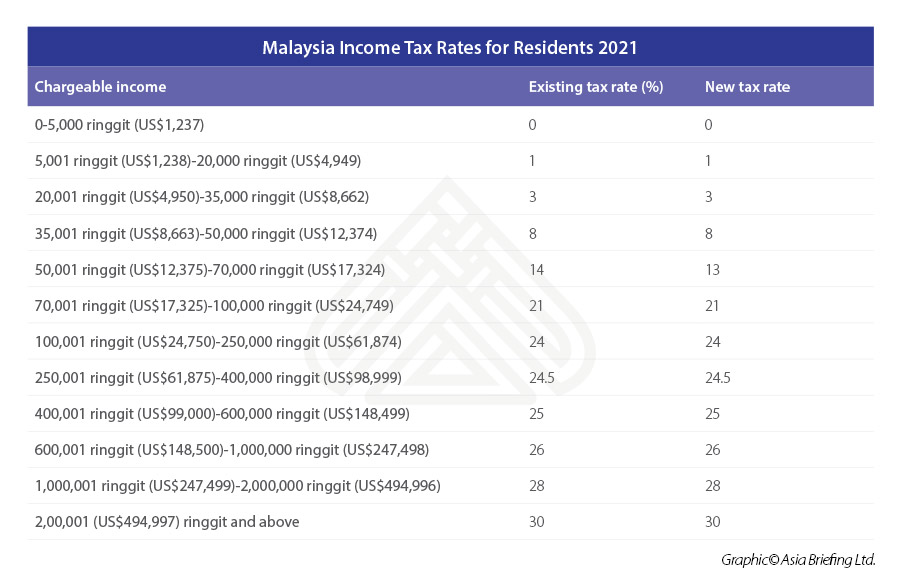

2 Income tax no. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

D 0012345602 D 3 Reference no. Tax rates range from 0 to 30. Income derived from the partnership is allocated to its partners based on the agreed profit sharing ratio and taxed in the.

B Gains profit from employment. D Enter the partnership income tax no. For income tax purposes a partnership is not a chargeable person.

Based on S 4 a income the tax of partnership does not exist simply because it is not a chargeable person to pay income tax but it is a chargeable person of Real Property. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Individual who received all types of FSI in Malaysia will be exempted from tax - for the period from 1 January 2022 to 31 December 2026 except for those individuals who.

A Gains profit from a business. Partnership income tax no. AF002133 201706002678 A member firm of Malaysian Institute of Accountants MIA Approved Company Auditor Income Tax Agent and GST Agent was.

Malaysian Personal Income Tax Pit 1 Asean Business News

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

No comments for "Partnership Income Tax Malaysia"

Post a Comment